The Full Belmonte, 3/14/2023

U.S. Inflation Cooled in February as Fed Confronts Bank Failures

Consumer prices rise 6% from year earlier, smallest annual gain since September 2021

“Elevated inflation cooled modestly in February, as the Federal Reserve faces dual threats of rising prices and financial instability.

The consumer-price index, a closely watched inflation gauge, rose 6% in February from a year earlier, versus a 6.4% gain the prior month, the Labor Department said Tuesday, the slowest pace since September 2021. The smaller increase comes as the Fed contemplates its next interest rate move while confronting price pressures and bank failures.

When excluding volatile food and energy prices, consumer prices advanced 5.5% from a year earlier in February compared with 5.6% in January. Economists view so-called core prices as a better indicator of future inflation.

Prices rose 0.4% in February over the prior month versus a 0.5% increase in January. Core prices increased by 0.5% in February compared with a 0.4% monthly gain in January.

Consumers paid less last month to heat their homes, and prices for medical services and used cars fell as well. Gasoline and food prices both increased, but at a slower pace than they did in January. Shelter costs increased 0.8% over the months.

Year-over-year inflation has cooled from a recent peak last June, but has remained stubbornly high. That combined with a strong labor market and solid consumer spending introduced the possibility that the Fed could raise its benchmark interest rate by a half-percentage-point at its March 21-22 meeting, after opting for a smaller increase in early February. But the collapse of Silicon Valley Bank and other financial institutions in recent days complicated that decision. The central bank may move more cautiously to assess the state of the financial system….” Read more at Wall Street Journal

President Joe Biden speaks about the US banking system on Monday at the White House in Washington, D.C.

Bank collapse

“President Joe Biden delivered a speech Monday in the wake of two major bank collapses. ‘Americans can rest assured that our banking system is safe. Your deposits are safe,’ Biden said from the White House. To quell fears, Biden said he had instructed his administration to take steps to protect small businesses and workers in the wake of regulator shutdowns of both Silicon Valley Bank and Signature Bank over the last few days, such as backstopping depositors' funds, while declining to extend relief to Silicon Valley Bank's investors. However, despite Biden's assurances, Wall Street's confidence remains shaky and some regional banks are showing signs of volatility.” [CNN]

Nuclear submarine deal to counter China’s growing influence

“The United States will spend billions of dollars expanding its ability to produce nuclear-powered attack submarines as part of a landmark security deal with Australia and the United Kingdom. The deal will provide Australia with the submarines, which can stay underwater longer than conventionally-powered ones and are harder to detect. Pending approval from Congress, the U.S. will sell at least three – and as many as five – Virginia-class submarines to Australia, once its navy is trained and ready to receive them.” Read more at USA Daily

US President Joe Biden (C) participates in a trilateral meeting with Australian Prime Minister Anthony Albanese (L) and British Prime Minister Rishi Sunak (R) during the AUKUS summit on March 13, 2023 in San Diego, California.

Leon Neal, Getty Images

How the Silicon Valley Bank collapse is affecting other US banks

“Before last week, there was little reason to suspect that you couldn't withdraw as much money from your bank account as you'd like at any given time. But as panicked customers rushed to SVB branches and crashed the bank's site once it became apparent that it was in trouble, many began to wonder if their money was safe where it was deposited. That fear directly flowed to Signature Bank, contributing to its collapse on Sunday.

What happened: SVB was taken over by the Federal Deposit Insurance Corporation on Friday after depositors, fearing the bank would soon become unable to pay its debts, began withdrawing money at an alarming rate.

•Federal regulators said depositors from both banks will get all their money. The Federal Reserve, the Treasury Department and the FDIC said regulators took the unusual step of guaranteeing the deposits because SVB presented a systemic risk to the U.S. financial system.

•Biden stipulated that ‘no losses’ stemming from the collapse of the Silicon Valley and Signature banks would be borne by taxpayers. He said he would ask Congress and federal regulators to tighten banking rules to make it less likely that a major failure happens again.

•Silicon Valley Bank's failure is the second largest since the 2008 financial crisis and came after struggling tech companies made a run on the bank, withdrawing cash at a rapid pace and forcing the bank into a position where it had to sell bonds at a loss to cover the withdrawals.

Here's a graphic explainer on how the SVB bank collapse went down.” [USA Today]

People stand outside of an entrance to Silicon Valley Bank in Santa Clara, California, Friday, March 10, 2023.

Associated Press

Biden approves massive oil project in Alaska

“The Biden administration approved the controversial Willow oil project, clearing the way for one of the largest new oil and gas developments on federal land in Alaska in 20 years despite fierce opposition from environmental activists. The move came as President Joe Biden also signaled sweeping future action to bar offshore drilling on 2.8 million acres in the Arctic Ocean in an appeal to critics who said he betrayed his commitment to fight climate change. The $8 billion project marks a shift in the Biden administration's handling of major fossil fuel projects after approving few without congressional or court intervention.” Read more at USA Today

Biden approves massive Alaskan Willow oil project, moves to bar future Arctic drilling

COURTESY CONOCOPHILLIPS

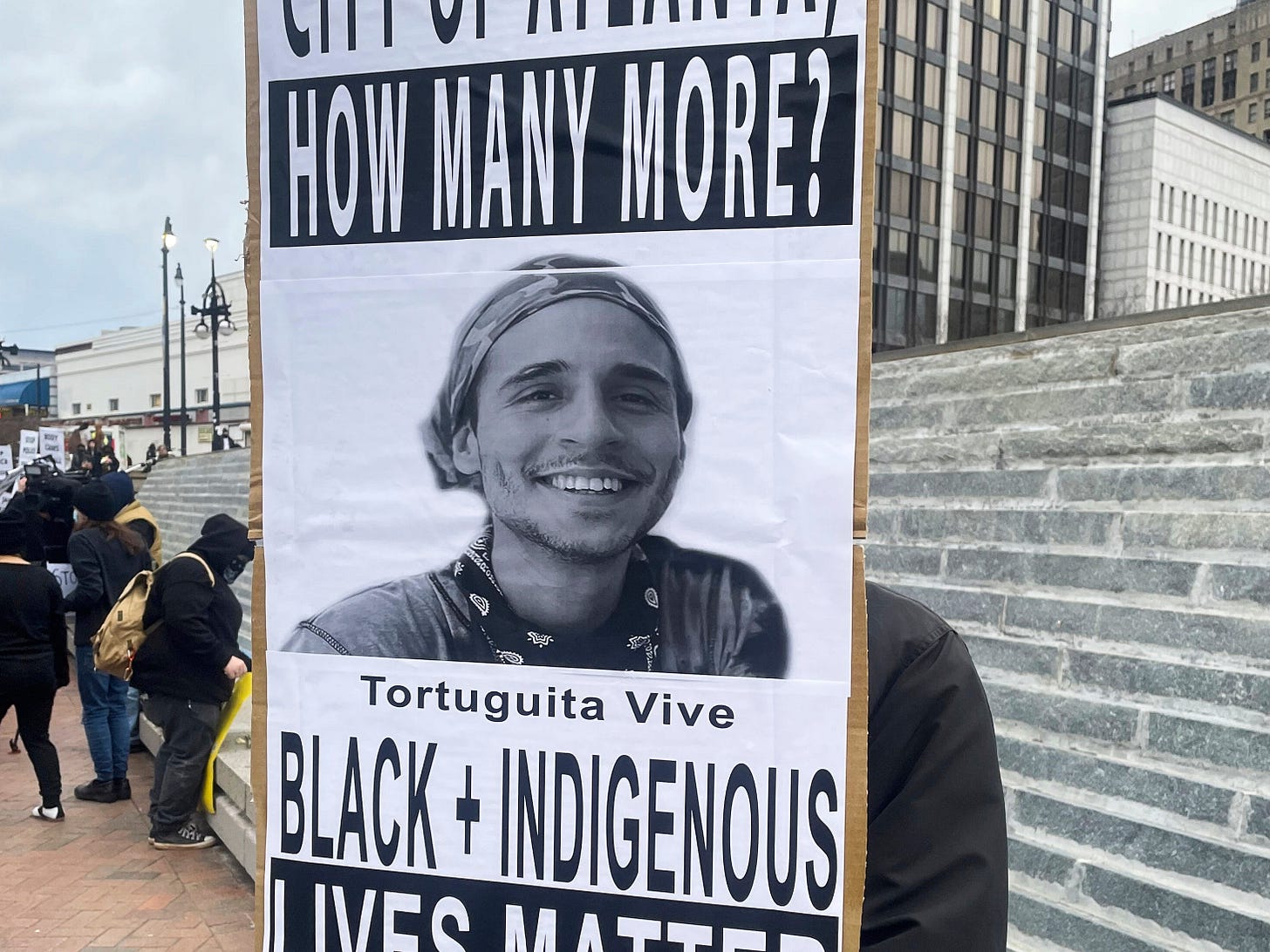

'Cop City' protester's hands were raised during Georgia fatal shooting, attorney says

“A private autopsy found a 26-year-old environmental activist who was protesting the construction of a police and fire training center near Atlanta had their hands raised when they were shot 14 times, attorneys said Monday. Manuel Paez Terán, who went by the name Tortuguita, was killed by police Jan. 18 after allegedly shooting a state trooper as law enforcement attempted to clear protesters from the site of the proposed Atlanta Public Safety Training Center, called ‘Cop City’ by its opponents. The family and their attorneys urged the city to release more information about Tortuguita's death. Read more at USA Today

A demonstrator holds a sign protesting the death of an environmental activist, who went by Tortuguita, in Atlanta, Georgia, on Saturday, Jan. 21, 2023.

R.J. Rico, AP

Novo Nordisk to Slash Insulin Prices by Up to 75%

The insulin maker is the latest to plan sharp price cuts for the diabetes treatments to make them more affordable

“Novo Nordisk A/S is set to cut the U.S. list prices for several insulin drugs by up to 75%, the latest big drugmaker to make steep price reductions amid pressure to curb diabetes-treatment costs.

Novo, one of the biggest sellers of insulin in the U.S. and around the world, said Tuesday it would cut the list price of its NovoLog insulin by 75% and the prices for Novolin and Levemir by 65% starting in January 2024.

In addition, Novo plans to cut prices for its unbranded insulin products to match the reduced price of Novo’s corresponding brands.

‘We have been working to develop a sustainable path forward that balances patient affordability, market dynamics and evolving policy changes,’ said Steve Albers, a Novo senior vice president. ‘Novo Nordisk remains committed to ensuring patients living with diabetes can afford our insulins, a responsibility we take seriously.’

Many people with insurance may not see a corresponding drop in costs because they pay fixed monthly copays. Yet uninsured people and those with high-deductible health plans could see reduced costs as a result of the price cuts.

Novo’s price cuts follow Eli Lilly & Co.’s decision earlier this month to reduce list prices for its most commonly prescribed insulin products by 70%, effective in the fourth quarter of 2023. Lilly also said it would expand a $35 monthly cap on patients’ out-of-pocket costs, among other steps.

Lilly, Novo and Sanofi SA are the leading sellers of insulins in the U.S. and worldwide. They had substantially raised the prices for their insulin products in the U.S. during the 2010s. The companies have said they didn’t make much from the higher list prices, because they had to pay larger rebates to the companies that manage drug benefits.

Before the price cuts, the products including NovoLog, one of the most widely used insulins in the U.S., cost hundreds of dollars a month. Levemir also is widely used.

Novo’s NovoLog currently has a list price of $558.83 for a five-pack of injection pens and $289.36 for a vial, though the company said most people with commercial insurance and Medicare don’t pay list price.

After the price cuts go into effect, those list prices will fall to $139.71 and $72.34, respectively, Novo said.

The price cuts cover insulins that come in both vials and injection pens.

Novo said it isn’t announcing any changes to certain existing savings programs aimed at limiting patients’ out-of-pocket costs. Under one program, copays for several of the company’s insulins are as little as $25 to $35 for eligible, insured patients. The company also provides a 30-day supply of a combination of insulins for $99.

For Novo, the list-price cuts may not materially hurt sales because the company already pays relatively high rebates to insurers and other payers, which reduce the portion of list prices that flow to the company. Novo’s insulin sales have declined in recent years. Analysts project sales of its noninsulin diabetes drugs will grow, especially sales of Ozempic, which many people are taking to lose weight.

Novo said the financial impact of the planned price cuts is uncertain….” Read more at Wall Street Journal

Ron DeSantis Says Protecting Ukraine Is Not a Key U.S. Interest

The Florida governor, on Tucker Carlson’s Fox News show, broke with Republicans to attack President Biden’s foreign policy and align more closely with Donald Trump as he weighs a presidential bid.

By Jonathan Swan and Maggie Haberman

“Gov. Ron DeSantis of Florida has sharply broken with Republicans who are determined to defend Ukraine against Russia’s invasion, saying in a statement made public on Monday night that protecting the European nation’s borders is not a vital U.S. interest and that policymakers should instead focus attention at home.

The statement from Mr. DeSantis, who is seen as an all but declared presidential candidate for the 2024 campaign, puts him in line with the front-runner for the G.O.P. nomination, former President Donald J. Trump.

The venue Mr. DeSantis chose for his statement on a major foreign policy question revealed almost as much as the substance of the statement itself. The statement was broadcast on ‘Tucker Carlson Tonight,’ on Fox News. It was in response to a questionnaire that the host, Mr. Carlson, sent last week to all major prospective Republican presidential candidates, and is tantamount to an acknowledgment by Mr. DeSantis that a candidacy is in the offing.

On Mr. Carlson’s show, Mr. DeSantis separated himself from Republicans who say the problem with Mr. Biden’s Ukraine policy is that he’s not doing enough. Mr. DeSantis made clear he thinks Mr. Biden is doing too much, without a clearly defined objective, and taking actions that risk provoking war between the U.S. and Russia….” Read more at New York Times

House Republicans Quietly Halt Inquiry Into Trump’s Finances

G.O.P. leaders are declining to enforce a court-supervised settlement for Mazars, Donald J. Trump’s former accounting firm, to turn over records in an investigation into whether he profited from the presidency.

By Luke Broadwater and Jonathan Swan

March 13, 2023

“WASHINGTON — House Republicans have quietly halted a congressional investigation into whether Donald J. Trump profited improperly from the presidency, declining to enforce a court-supervised settlement agreement that demanded that Mazars USA, his former accounting firm, produce his financial records to Congress.

Representative James R. Comer, Republican of Kentucky and the chairman of the Oversight and Accountability Committee, made clear he had abandoned any investigation into the former president’s financial dealings — professing ignorance about the inquiry Democrats opened when they controlled the House — and was instead focusing on whether President Biden and members of his family were involved in an influence-peddling scheme.

‘I honestly didn’t even know who or what Mazars was,’ said Mr. Comer, who was the senior Republican on the oversight panel during the last Congress, while Democrats waged a lengthy legal fight over obtaining documents from the firm.

‘What exactly are they looking for?’ Mr. Comer added in a brief statement to The New York Times on Monday. ‘They’ve been ‘investigating’ Trump for six years. I know exactly what I’m investigating: money the Bidens received from China.’

He confirmed the end to the inquiry into Mr. Trump after Democrats wrote to Mr. Comer raising concerns about the fact that Mazars, the former president’s longtime accounting firm that cut ties with him last year, had stopped turning over documents related to his financial dealings. The top Democrat on the panel suggested that Mr. Comer had worked with Mr. Trump’s lawyers to effectively kill the investigation, an accusation the chairman denied….” Read more at New York Times

Nor'easter

“A rapidly intensifying nor'easter will bring heavy snow, winds and coastal flooding today across the US Northeast, threatening widespread power outages and making travel impossible in some areas. A nor'easter is a storm that travels along the US East Coast and typically has coastal winds out of the northeast. They typically form between September and April and are strongest during the winter months. Ahead of today's anticipated conditions, more than 20 million people are under winter weather alerts across the region. Several governors have implemented preemptive measures as forecasts show widespread snowfall up to 18 inches is likely from northeastern Pennsylvania and far northwestern New Jersey through much of upstate New York and New England. Meanwhile, another atmospheric river is creeping into storm-ravaged California, fueling more evacuation alerts and flooding concerns.” [CNN]

Tourism

“As many Americans gear up for spring break vacations and international trips, Texas state officials recently advised against travel to Mexico, citing the risk of cartel violence. (The guidance comes just a few weeks after the high-profile kidnapping of four Americans drew global attention to the country's security crisis.) However, Mexican President Andrés Manuel López Obrador argued on Monday that Mexico is safer than the US. The Mexican president also claimed there was ‘a campaign against Mexico from conservative US politicians that don't want this country to keep developing for the good of the Mexican people.’ Separately, China is fully reopening to tourists after three years of border restrictions, officials announced Monday. The country is set to resume issuing all categories of visas for foreigners beginning Wednesday.” [CNN]

Opioid crisis

“The US government on Monday sued Rite Aid, accusing the pharmacy chain of missing ‘red flags’ as it illegally filled hundreds of thousands of prescriptions for controlled substances, including opioids. The Department of Justice alleged Rite Aid repeatedly filled prescriptions that were medically unnecessary, for off-label use or not issued in the usual course of professional practice between 2014 to 2019, according to a complaint filed in federal court. Rite Aid pharmacists were accused of ignoring obvious signs of misuse, including in prescriptions for ‘trinities,’ a combination of opioids, benzodiazepine, and muscle relaxants preferred by drug abusers for their increased euphoric effect, the complaint states. The Justice Department has also sued Walmart and drug distributor AmerisourceBergen Corp over their alleged roles in the nation's opioid crisis.” [CNN]

Polish court convicts activist of providing abortion pills in landmark case

By Kate Brady and Claire Parker

“A Polish court convicted a human rights activist on Tuesday of illegally providing abortion pills and sentenced her to eight months of community service, in a case that has resonance for a post-Roe United States.

For decades, majority-Catholic Poland has had some of Europe’s strictest abortion laws, which were tightened further in 2020 by banning exceptions for cases of fetal abnormalities. While performing an abortion on yourself is legal, aiding someone else is not.

Justyna Wydrzynska, who co-founded Abortion Dream Team that provides people with information about how to safely terminate their pregnancies, told The Washington Post that her case was being used by the government to set an example and ‘close the mouths of all the activists in Poland.’

‘They will not succeed in this because we are not afraid of them. I am not afraid of the verdict,’ she said the day before it was announced.

In her final statement in court before the verdict, Wydrzynska wept and described her own experiences of domestic violence and how she wanted to help others.

The case has had particular resonance in the United States following the overturning of Roe v. Wade in June 2022, and several states installing restrictive abortion laws. While the Biden administration has said abortion pills are authorized as safe and effective for use in all 50 states,providing them to people in the 11 states where abortion is now illegal remains a gray area.

In Texas, for instance, a man has filed a wrongful-death suit against three women who assisted his now ex-wife in acquiring the medication to terminate her pregnancy in the first such case brought since the state’s near total abortion ban passed.

While abortion in Poland is still permitted in cases of rape, incest or threat to the mother’s life, there is effectively a total ban since finding a doctor to carry out an abortion under those circumstances is difficult.

Rape victims must provide a certificate from a prosecutor for the procedure, and many doctors are afraid to provide care to pregnant people experiencing obstetric emergencies out of fear of breaking the law.

One pregnant woman, 30-year-old Izabela Sajbor, died of septic shockat a Polish hospital in September 2021 after medical workers refused to treat her until her fetus died, her lawyer said. In January 2022, a second woman known as Agnieszka T. died in the first trimester of a twin pregnancy after doctors, wary of violating the law, refused to carry out an abortion when the heartbeat of one fetus stopped.

Obtaining abortion pills, however, remains relatively easy, Wydrzynska said. ‘What is tricky and quite tough, is that you have to do everything by yourself.’

The woman Wydrzynska is accused of giving abortion pills to has been identified as Ania. According to a briefing on the case, published by the International Planned Parenthood Federation, she reached out to Abortion without Borders in February 2020. She decided to have an abortion, but threats from her husband prevented her from traveling to a clinic in Germany.

Abortion pills are booming worldwide. Will their use grow in Texas?

As the coronavirus pandemic picked up speed and international mail becoming less reliable, and Wydrzynska posted Ania the abortion pills from her house. Ania’s husband reportedly found the pills, however, and called police, who confiscated them. Ania said the stress of the police investigation led her to miscarry.

Wydrzynska’s home was searched and police discovered mifepristone and misoprostol, common abortion medications, and five months later, in November 2021, she was charged with possession of unauthorized medicines and aiding an abortion.

Despite the sentence, Wydrzynska describes the attention the case has drawn as a success for abortion rights activism.

‘We really succeeded. Because of the case everybody knows in this country about Abortion without Borders — that we help not only logistically, but also financially. Everybody knows that you can order abortion pills and it’s easy and legal.’

Throughout the trial, she persisted in her efforts to make abortions available to those in Poland who need them, though she admitted ‘it was kind of tough to still be working and to be on trial.’

Activists say the trial is as much a test of Poland’s abortion law as the independence of its judiciary, which has prompted international concern in recent years.

Since coming to power in 2015, Poland’s Law and Justice party has changed the process of appointing, promoting and disciplining judges so that they are beholden to the ruling party.

‘The judge of my court case was nominated by the general prosecutor in 2019 and previously she was a prosecutor so we know that she is somehow connected with the Justice Ministry,’ said Wydrzynska.” [Washington Post]

Ukraine

“Russia on Tuesday launched multiple attacks across Ukraine's eastern Donetsk region, killing at least three people and wounding several others, while evacuations are being ordered from the city of Kupiansk in the Kharkiv region as Russian forces creep closer again. Ukraine's future is being decided in its east, where the fighting remains ‘very tough,’ President Volodymyr Zelensky said in his latest nightly address. This comes as analysts say Russia's Wagner assault units are sustaining ‘significant losses’ as the mercenary group attempts to advance from several directions.” [CNN]

“Xi Jinping is playing peacemaker in the Middle East. Next up: Russia and Ukraine.

The Chinese president is looking to bolster his credibility as a responsible global actor after successfully helping to deliver a landmark deal to resume diplomatic ties between Iran and Saudi Arabia.

Now, Xi’s forging ahead with a trip to Moscow to meet President Vladimir Putin, and plans to hold his first-ever call with Ukrainian President Volodymyr Zelenskiy. He might even put in another call to Joe Biden to help ease spiraling tensions with the US.

Despite skepticism among the US and its allies over China’s 12-point position paper for a ceasefire between Russia and Ukraine, Beijing may well end up urging Zelenskiy to agree to peace talks.

While Xi has spoken to Putin four times since the invasion, the Ukrainian leader has been careful to avoid criticizing Xi’s close ties to Moscow and remains open to discussions.

Beijing’s success as a mediator between Iran and Saudi Arabia is a coup for Xi. It’s a testament to China’s success in building an alternative world order to challenge the US and forge closer ties with Russia.

But China’s push to create its own powerbase — strengthening ties in the Middle East and with Moscow — is also the reason why Beijing may struggle to convince the US and its allies that it can play the role of honest broker.

Beijing’s insistence on challenging so-called Western hegemony is precisely what undermines Xi’s prospects as a peacemaker in Ukraine.” —Rebecca Choong Wilkins [Bloomberg]

Saudi Crown Prince Mohammed bin Salman and Xi in 2016. Source: Pool/Getty Images

Bali plans tourist motorbike ban over misbehaviour

Image caption,

Bali's governor wants to ban foreign tourists from renting and riding motorbikes

By Jerome Wirawan, Quinawaty Pasaribu and Kelly Ng

“The Indonesian island of Bali is planning to ban foreign tourists from using motorbikes after a spate of cases involving people breaking traffic laws.

‘You [should] not roam about the island using motorbikes, without wearing shirts or clothes, no helmet, and even without a licence,’ Governor I Wayan Koster said.

Under the proposals tourists would use cars provided by travel agents instead.

The plan has been divisive as tourism continues to recover from Covid losses.

More than 171 foreign nationals have violated traffic orders from late February to early March, according to local police records. Some tourists also use fake licence plates.

‘If you are a tourist, then act like a tourist,’ said the governor.

Foreign tourists in Bali often prefer renting motorbikes to get around the island, which does not have a well-developed public transport system. The two-wheelers make for a good option for weaving in and out of traffic, as well as travelling through scenic back alleys.

The proposed ban will be implemented via a regional law sometime this year, but how it will be enforced is unclear.

One Ukrainian tourist - who asked not to be named - said foreigners should be ‘given the freedom’ to ride motorbikes as long as they provide valid licences.

‘We don't use the services of a travel agent because we want to be independent and like to do things ourselves so we can feel the atmosphere,’ she told BBC Indonesian.

Finnish tourist Kristo, on the other hand, supports the proposed ban. ‘Many riders behave like they are drunk and do not wear helmets. That is very dangerous,’ he told Indonesian news website detik.

But some operators have raised concerns over its effect on business.

Dedek Warjana, who chairs Bali's motorbike rental association, said the proposal was hasty and authorities should act on specific violations instead of imposing a blanket ban.

Allowing foreign tourists to only rent cars may exacerbate congestion, he said.

A ban could tarnish Indonesia's reputation in the eyes of other countries, said Nyoman Sukma Arida, a lecturer in tourism at Bali's University of Udayana.

The growing number of traffic violations also points to weak enforcement of existing rules by the local authorities, he said.

He suggested strengthening the vehicle rental system, such as by making sure those who rent have valid driver's licences, requiring security deposits, and taking action on riders who violate rules.

After all, not every traveller behaves badly, he said.

The governor also announced a plan to revoke visa-on-arrival permits for tourists from Russia and Ukraine because of misconduct. Many people from the two countries have ‘flocked to Bali’ amid the war but are not abiding by local regulations, he said.

In the past week, for instance, authorities arrested several Russian citizens for violating their residence permits. Some also misused visitors' visas to set up businesses.

Tourism contributed some 60% to Bali's annual GDP before the pandemic. According to the province's statistics bureau, Australia was the largest contributor of foreign tourists to Bali in January 2023 - with more than 91,000 Australians arriving in the province. Russia took the second spot, with about 22,000 of its citizens visiting the province that month.” [BBC]

March 14, 2023

By German Lopez

Good morning. Deregulation contributed to Silicon Valley Bank’s collapse.

Silicon Valley Bank in Santa Clara, Calif.Jim Wilson/The New York Times

Stopping the fallout

“The collapse of Silicon Valley Bank and others — and the government’s rescue over the weekend — left many of us again rushing to understand the arcane details of the financial system. It can be maddeningly complex, so I want to use today’s newsletter to explain some of the basics.

First, the latest: Bank stocks plummeted yesterday, hitting midsize and smaller institutions in particular. Other financial markets gyrated as well, despite U.S. policymakers’ emergency help for customers of the closed banks. ‘It didn’t put calm back in the system,’ said my colleague Maureen Farrell, who covers business.

Why does this matter to everyday Americans? After all, SVB is relatively small and most of us keep no money in it.

The short answer is the potential for wider fallout. When banks collapse, other people sometimes fear that their own banks and investments will follow. Even healthy banks don’t keep enough cash on hand to pay out all depositors, so if too many people panic at once and pull out their money — a classic bank run — it could lead to broader financial and economic calamity. And that is what the Biden administration and the Federal Reserve are trying to stop: a financial crisis largely prompted by plunging confidence.

The collapse

As its name suggests, the bank portrayed itself as focused on the leading edge of technology. And it served thousands of tech firms. Yet SVB invested their money in something much less exciting, as Paul Krugman wrote: U.S. bonds, effectively I.O.U.s from the federal government.

Because the federal government has always paid its bills, U.S. bonds are widely considered the safest investment. SVB’s experience shows there are moments when even these safe investments may not pay off. The details get technical, but they’re worth unpacking to understand what went wrong.

Bonds are effectively money that the government borrows from buyers — the public — before paying them back later, with interest. Market conditions and the Federal Reserve, America’s central bank, help determine that interest rate.

When SVB bought bonds, interest rates were very low. Since then, the Federal Reserve, which sets certain influential rates, increased those to combat rising prices. Now, new bonds can carry interest multiple times higher than those SVB bought.

Imagine, then, that you want to buy bonds today. You would want the newer bonds because they have a higher payout. So when SVB needed to sell bonds, to raise cash that it could use for its customers’ withdrawals, it could do so only for a discount, taking a loss.

The bank failed to follow basic financial advice: Diversify your portfolio. ‘It’s not fraud,’ said Joseph Gagnon, a senior fellow at the Peterson Institute for International Economics. ‘But it’s an extremely risky, and obviously risky, strategy.’

In the past few weeks, venture capitalists and other wealthy customers on social media and in private chats started discussing concerns that SVB could no longer pay its depositors. Some began to move their money out of the bank, and the situation spiraled quickly. ‘Once you start asking, ‘Are we having a bank run?,’ it’s too late,’ my colleague David Enrich, a business editor, said.

A regulatory failure

Financial regulations are supposed to stop these kinds of crises. But Silicon Valley Bank’s problems were not caught until it was too late — which many experts say was a result of insufficient oversight. (Here’s what to know about how your own money is covered.)

Under pressure from banks in 2018, Congress passed bipartisan legislation that Donald Trump signed into law shielding smaller banks, like SVB, from more stringent rules. The banks argued that they were so small that they posed little risk to the broader financial system.

SVB’s collapse and the aftermath suggest the banks’ claims were wrong: Even smaller bank failures can threaten the financial system as a whole, prompting some experts — but not all — to call for the federal government to get more involved.

Controlled slowdown

To readers of this newsletter, the Federal Reserve’s involvement in containing the fallout of Silicon Valley Bank’s collapse may be puzzling. The Fed, after all, has been raising interest rates to slow the economy. An economic slowdown inherently involves businesses, including banks, failing.

The Fed’s concern is that the bank collapses could go too far and pose bigger systemic risks beyond SVB. Think of it this way: You can stop a runaway car by blowing out its tires, potentially causing a crash. But it would be better if the car stopped by simply braking. Officials are trying to get the economy to brake to a safer speed — one in which inflation isn’t so high.

The economic slowdown that the Fed hopes for would still affect everyday Americans, in both lower prices and also potentially higher unemployment rates. But that outcome is better than an uncontrolled bank run that topples the financial system and takes the rest of the economy, and your 401(k), down with it.

More news

Smaller U.S. banks are battling market turmoil as customers withdraw deposits and investors dump stocks.

The Fed could become more cautious about raising interest rates to control rising prices. New inflation data comes out today.

SVB’s collapse has exposed the tech industry’s vulnerabilities.

The bailouts after the 2008 financial crisis arguably saved the global economy. But a popular backlash continues to haunt Washington. (Biden won’t utter the word.)

SVB was the biggest bank to fail since 2008. This chart explains how it compares to other collapses.” [New York Times]

Facebook Parent Meta Begins New Round of Job Cuts

Fresh layoffs will trim 10,000 jobs, on top of 11,000 cuts announced last fall

Meta says the layoffs are aimed at making Facebook more efficient. PHOTO: TONY AVELAR/ASSOCIATED PRESS

“Facebook parent Meta Platforms Inc. said it would cut roughly 10,000 jobs over the coming months, the company’s second major round of layoffs, in an effort to make it more efficient in a difficult economy.

Meta Chief Executive Mark Zuckerberg said in an email to staff on Tuesday that the company would in the coming months conduct multiple rounds of job cuts, as well as cancel some projects and reduce hiring rates as part of what he has dubbed the ‘year of efficiency.’

Company recruitment teams will be cut first, followed by restructuring and layoffs in its technology groups in late April, Mr. Zuckerberg said. Business teams will face layoffs in May, he added….” Read more at Wall Street Journal

Nancy Yao is president of the Museum of Chinese in America.The Museum of Chinese in America

Closer to reality

“The Smithsonian’s American Women’s History Museum is early in development. But the institution took a major step yesterday, naming Nancy Yao, the president of the Museum of Chinese in America in New York, as its founding director.

More than two years after Congress approved its creation, the Women’s History Museum has yet to decide on an architect, a location or its collection. But it already has more than $55 million in pledged donations from philanthropists, including Melinda French Gates, Tory Burch and the Walmart billionaire Alice Walton.” [New York Times]

Patricia Schroeder, congresswoman who wielded barbed wit, dies at 82

“Former congresswoman Patricia Schroeder, a megaphone for the women’s movement, the first woman to serve on the House Armed Services Committee and a liberal Democrat known for her barbed wit, notably coining the term ‘Teflon president’ to lambaste President Ronald Reagan, died March 13 at a hospital in Celebration, Fla. She was 82.

The cause was complications from a stroke, said her daughter, Jamie Cornish.

Mrs. Schroeder, who grew up in a household where her father assumed women could do anything, earned a pilot’s license at 15, weathered sexism to become a Harvard-trained lawyer and was a 32-year-old mother of two when she was first elected to Congress from Colorado in 1972. ‘I have a brain and a uterus, and I use them both,’ she quipped when one male lawmaker questioned how she could be a wife, mother and congresswoman.

When she arrived in Washington, there were only 14 women in the House, several of whom were widows filling out the terms of their deceased husbands. She described the institution as ‘an overaged frat house.’

During her 12 terms in the House of Representatives, Mrs. Schroeder was outspoken on issues that ranged from women’s rights and family matters to military policy. She was appointed to the House Armed Services Committee and then fought vigorously to be heard and respected.

F. Edward Hébert of Louisiana, the committee’s hard-line conservative Democratic chairman, allowed just one seat in the hearing room to be shared by Mrs. Schroeder and Ron Dellums, a newly elected African American congressman from California. She recalled Hébert saying, ‘The two of you are only worth half the normal member.’

Mrs. Schroeder said she and Dellums ‘sat cheek to cheek on one chair, trying to retain some dignity.’

Hébert was stripped of his chairmanship two years later in a revolt by younger committee members, but before his ouster, Mrs. Schroeder did her best to get under his skin. He returned the favor, refusing to approve her appointment to a U.S. delegation heading to an overseas conference.

‘I wouldn’t send you to represent this committee at a dogfight,’ Hébert reportedly remarked, according to a Washington Post profile of Mrs. Schroeder. The State Department eventually waived the rule requiring the chairman’s approval of all nominations, and Mrs. Schroeder made the trip.

While often on the losing end of defense debates, Mrs. Schroeder believed that her fight against the Pentagon’s ‘outrageous’ requests helped to create ‘a political climate conducive to meaningful reform.’ A strong proponent of arms control, she derided the Armed Services Committee as a Pentagon ‘lap dog’ and rankled the military brass by constantly questioning their spending habits.

During a 1973 debate over a weapons system, she used mocking language invoking a slick Madison Avenue sales job: ‘Is it bigger? Is it faster? Is it more maneuverable? Does it give closer, more comfortable shaves?’ On another occasion, she chided those who thought that ‘killing an enemy 15 times over makes us more secure than if we can kill him only five times over.’

On the domestic front, Mrs. Schroeder from 1979 until 1995 co-chaired the Congressional Caucus for Women’s Issues, a bipartisan group of lawmakers devoted to advancing legislation on reproductive rights, women’s equity and workplace flexibility for parents.

She was the primary sponsor of the National Child Protection Act of 1993, which established procedures for national criminal background checks for child-care providers, and she played a pivotal role in the passage of the Violence Against Women Act of 1994, which was intended to help law enforcement and victim services organizations fight rape and other forms of violent crime against women.

Mrs. Schroeder also was a strong advocate for the Breast and Cervical Cancer Mortality Prevention Act of 1990, which provided lower-income women with breast and cervical cancer screening and post-screening diagnostic services in an effort to enhance early detection. The law, however, did not pay for treatment, placing many uninsured women in a predicament of not being able to afford care. A decade later, Congress passed legislation providing medical assistance to eligible uninsured women through Medicaid.

She spent nine years championing the Family and Medical Leave Act, which was approved by Congress in 1993 and provides job protection for up to 12 weeks of unpaid leave for the care of a newborn, sick child or parent. And as chairwoman of a Post Office and Civil Service subcommittee, she was a leading advocate for federal employees in such areas as whistleblower legislation….” Read more at Washington Post